Nevadans are getting crushed by car debt and nobody’s talking about it.

Go ahead. Ask around. Ask your neighbor, your cousin, your buddy at work. “Are you behind on your car loan?”

Odds are, they’ll either laugh it off or change the subject.

Because the truth is ugly: More people are behind on their car payments now than before the pandemic.

And it’s not just because rates went up. It’s because they’re stuck in monster loans for cars that aren’t worth the paper the contract was printed on.

This is what the Federal Reserve just confirmed. And it’s hitting Nevada like a freight train.

Upside Down and Nowhere to Go

Let’s break this down.

According to Edmunds, over 1 in 5 people with a car loan right now owe more than their vehicle is worth.

That’s 20 percent of folks sitting behind the wheel of a car they technically don’t even own.

And get this: the average “negative equity” amount? Over $10,000. That’s ten grand in the hole.

You’re paying for the past.

That shiny new ride from 2021? It’s now worth $15K, but you still owe $25K.

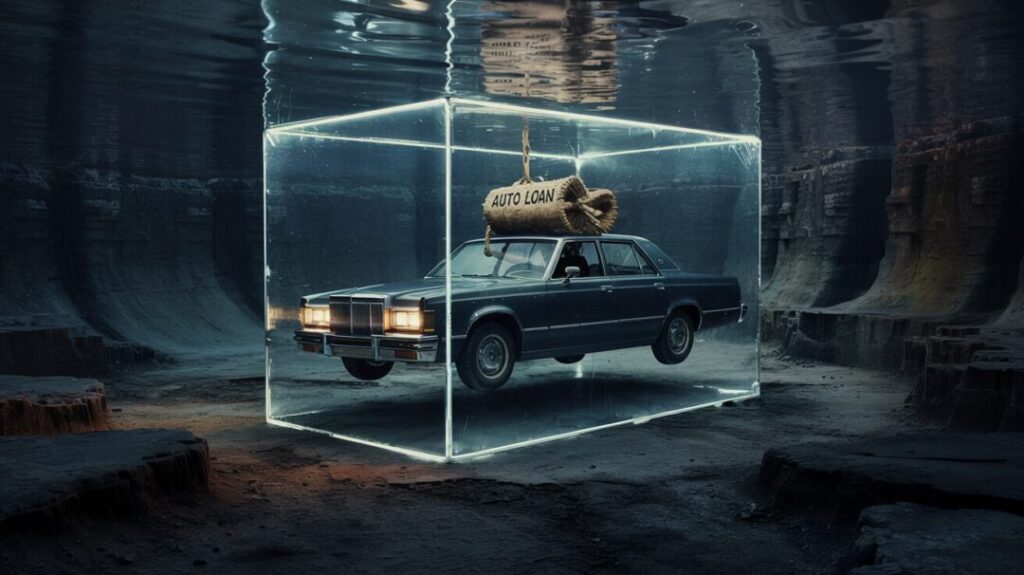

And the kicker? You can’t sell it. You can’t trade it. You’re trapped.

This isn’t a luxury problem. This is happening to middle-class families in Las Vegas, Henderson, and beyond who just needed a way to get to work.

The Scam Started During COVID

Remember when car lots were empty, and people were paying sticker price plus a five-grand “market adjustment”?

Dealers were smiling. Buyers were desperate. Everyone needed a car. And the government was handing out cash like candy.

So folks signed for bigger loans, longer terms, and higher payments.

Now? Reality’s catching up.

The Fed says monthly payments are way up not just because of rates, but because loans got super-sized.

Average new car loans are over $40,000. That’s more than half the annual income for a lot of Nevadans.

And when things got tight?

There were no breaks. No forgiveness. No bailout. Just a tow truck and a repossession notice.

The COVID Loans Are Haunting Us

A report from the Philadelphia Fed showed 12% of those so-called “relief” loans from the COVID years re-defaulted. Surprise, surprise.

Delaying a punch in the face doesn’t make it hurt less. It just means you didn’t see it coming.

People are still digging out from pandemic debt. And when food, gas, and rent all go up… guess what bill doesn’t get paid?

That overpriced auto loan.

Banks Should Be Worried Too

Here’s the part nobody at the big banks wants to talk about.

The FDIC says that if these banks keep merging and growing like weeds – especially those sitting on a pile of bad car loans – it could shake the whole financial tree.

And when the branches snap, it’s not the CEOs in D.C. who get crushed.

It’s the working mom in North Las Vegas whose car just vanished from the driveway in the middle of the night.

Let’s Talk Common Sense

Now, sure, some critics will wag their finger and say, “Well, people shouldn’t borrow what they can’t pay back.”

Yeah? Maybe.

But when a single mom in Boulder City has to drop $700 a month on a used Honda Civic just to keep her job, that’s not bad planning. That’s economic insanity.

We don’t need lectures.

We need leaders who’ll stop printing money, stop playing footsie with Wall Street, and stop pretending everything’s fine while Nevadans can’t even afford to drive to work.

Gov. Joe Lombardo gets it. He’s pushing back on federal nonsense and calling for fiscal sanity. More of that, please.

Cars aren’t supposed to own people. But right now, too many Nevadans are shackled to overpriced vehicles and bloated loans.

And unless something changes fast, this problem won’t stay in the garage. It’ll be parked right at our front doors.

The opinions expressed by contributors are their own and do not necessarily represent the views of Nevada News & Views. This article was written with the assistance of AI. Please verify information and consult additional sources as needed.