As Obama, Reid tout clean energy at Vegas summit, investigation shows their involvement in failure of Nevada revolving loan program

(Steven Miller, NPRI) – When Sen. Harry Reid and President Barack Obama return to Las Vegas Monday for Reid’s 8th Annual National Clean Energy Summit, there’ll be a ghost with them on the dais.

(Steven Miller, NPRI) – When Sen. Harry Reid and President Barack Obama return to Las Vegas Monday for Reid’s 8th Annual National Clean Energy Summit, there’ll be a ghost with them on the dais.

Call it the “Ghost of Stimulus-Act Past.” Or perhaps “The Spirit of Green-Energy Subsidy Failures Past.”

No matter what it’s called, the thing is out of the grave and again stalking the land.

It’s back because every million-dollar-plus renewable-energy loan that Nevada gave to green-energy companies, using its Stimulus Act dollars, subsequently failed and is now the target of “clawback” legal actions by the state.

That’s what an “informational” report deep inside a 54-page “exhibit” given the 2015 Nevada Legislature’s Senate Finance Committee — and turned over to Nevada Journal by a concerned lawmaker — says.

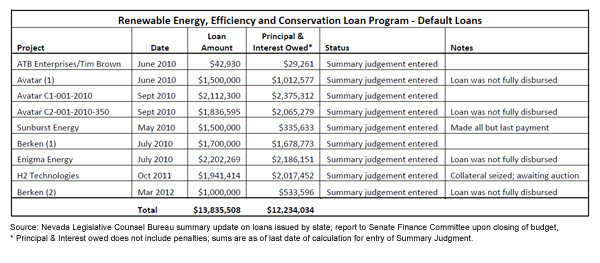

Of $13.8 million loaned out by the state, the cumulative amount not remitted, according to legislative staff, exceeded $12.2 million, or something over 88 percent:

In 2009 and 2010, the two foremost champions of the federal Stimulus Act were the President and Nevada’s senior Senator.

While the public was assured the decision-making process behind the green loans was an objective and disinterested scientific process, personnel inside the U.S. Department of Energy, a Congressional report showed, discussed with each other frequently the aggressive political interventions by both figures.

A May 2010 email reveals that, after Reid had requested a meeting with the head of the Stimulus Act’s DOE loan program, former Obama campaign bundler Jonathan Silver, that meeting somehow expanded greatly — all the better to pressure the loan program head.

“The mtg on Thursday afternoon, originally scheduled weeks ago as a mtg with the Majority Leader and me has turned into a much bigger affair,” wrote Silver in an email to DOE staff. “It now includes Secretary [of Energy Steven] Chu, [Office of Management and Budget Director] Peter Orszag, Senator Reid and Senator [Jeff] Bingaman [of New Mexico].”

Silver — aware of a September 2009 letter Reid had written Obama, complaining of the alleged “slow pace of implementation” of the DOE’s loan programs — judged Reid’s meeting request was part of the senator’s increasingly anxious campaign to hang onto his Senate seat.

“Reid is constantly hit at home for not bringing in the federal dollars,” Silver wrote. So — according to the briefing memo DOE staffers prepared for the meeting — Silver was advised to assure Reid that “we anticipate a good number of projects to be approved in the coming months.”

Within Nevada also, the political pressure to rush projects through the approval process was remarkably intense, and Reid was active there, too.

Members of his staff sat in on the key September 2009 meeting of the state legislative panel to which the full legislature had handed oversight responsibilities regarding Nevada’s pursuit — and spending — of the federal stimulus dollars.

Minutes show that the senator’s Southern and Northern Nevada offices were both represented.

Democratic state lawmakers then spent most of the long meeting pressuring representatives of the different executive-branch agencies to move even faster to approve projects, get the federal government’s approval — despite the feds’ own foot-dragging — and get the money.

State Sen. Steven Horsford, especially, subjected the newly appointed acting manager of the state Office of Energy, James Brandmueller, to a prolonged and even at time embarrassing verbal flogging, demanding that the office move ever faster.

A Nevada Journal investigation has found that the immense pressure applied to Nevada Office of Energy had its effect, but that effect was not good.

It’s something, however, you would not know if you only knew what state government in Carson City was telling you.

Take, for example, the state’s “Nevada Governor’s Office of Energy” web page devoted to the office’s Revolving Loans Program.

As of the preparation of this news story, that page still boasted:

Nearly $13 million was funded under the federal American Recovery and Reinvestment Act of 2009 to provide short-term, low-cost loans to developers of renewable energy projects, renewable component manufacturers, energy efficiency, and energy conservation projects in Nevada. These loans serve as a bridge financing option to provide funding for various startup costs associated with these projects….

The original $8.2 million in funding has been built up to more than $12.8 million, mainly due to moving unspent ARRA funds from other programs into the Loan Fund. According to the U.S. Department of Energy, Nevada was the first state to have 100 percent of its ARRA revolving-loan funds allocated, indicating efficiency by the Energy Office as well as the industry’s interest in developing projects in Nevada. Additional funding is being sought to continue to grow the existing the program. (Emphasis added.)

Notably, the significantly out-of-date web page does not reflect the current financial status of the Governor’s Office of Energy’s revolving loan fund. Rather than the $12.8 million in the fund the page reports, the actual sum, according to legislative staff in their 2015 report, was only $1.2 million:

The reduction in the anticipated loan repayment amount resulted in a corresponding reduction in the amount of funding anticipated to be available for energy loans from the $3.4 million approved by the 2013 Legislature to $1.2 million.

Similarly, the “Office History and Accomplishments” page of the energy office cites as one accomplishment the U.S. Department of Energy’s commending the office being “instrumental in promoting and implementing effective energy efficiency and renewable energy programs throughout the State of Nevada.”

The boasting over the renewable-energy revolving fund — and the bragging over commendations from the Obama Administration for approving projects faster than any other state — started early, long before any results were in.

In a February 2011 letter to Mike Schneider, the then-chairman of the Senate Commerce and Labor Committee, the new director of the state energy office, Stacey Crowley, characterized the revolving fund program as already successful:

The Fund for Renewable Energy, Energy Efficiency and Energy Conservation Loans (“Fund”) is a successful, low-interest rate loan program that provides financing for renewable energy projects. This Fund originated from an $8.3M American Recovery and Reinvestment Act (ARRA) grant through the Nevada State Office of Energy.

Then a month later, in another letter to Schneider, Crowley doubled down, asserting:

The Fund has been a success, both in terms of getting stimulus dollars out to innovative companies and getting jobs on the ground, as well as by establishing a structure for an on-going, “revolving” loan program that will continue to provide financing for innovative energy projects. For example, as a result of receiving funds through this program, at least two companies are in the process of locating manufacturing plants to Nevada that will provide hundreds of jobs to Nevadans.

In actual fact, while millions of dollars had, indeed, been given out, none of the biggest recipient companies would prove themselves financially viable nor able to produce market-sustainable jobs.

Approximately a year later, in early 2012, the company that had received most of the initial $8.3 million ARRA grant, Avatar Energy Nevada, was already asking the energy office for an easier payment plan than what had originally been agreed upon.

At the same time, however, Crowley was touting the revolving-loan program in Washington, D.C., at a National Association of State Energy Officers policy conference.

Her presentation — titled “Expanding Economic Growth Opportunities through Clean Energy Financing” — boasted that over $12 million in low-cost loans had gone to people promising to accomplish 15 different renewable-energy projects.

Crowley also noted that the U.S. Department of Energy had “recognized” the state energy office for its “pace-setting” distribution of loans, and that the Nevada “Revolving Loan Program was the first in the U.S. to fully loan” out the federal stimulus money it had received.

Her presentation especially highlighted the almost $6 million the State of Nevada had loaned Avatar Energy, to facilitate the placement of anaerobic-digester installations at three different Silver State dairy farms.

Those three projects, Crowley told her audience, would create 45-plus Nevada jobs. Moreover, because the loans were revolving, they would free up capital for one or two biogas-industry related manufacturing plants in the state — from which 200-to-400 jobs could be expected over the next three years.

Similarly, the talk from Avatar Energy Nevada and its California parent company, Avatar Energy LLC, was grandiose. In the letter introducing both companies to the Nevada energy office, Catherine Brennan, titled the chief financial officer of the LLC, wrote:

Avatar is an innovative energy company that produces an affordable, modular anaerobic digester which reduces dairy costs while providing a renewable source of energy for dairy farmers, regardless of herd size. Avatar’s scalable digester converts manure waste into electricity, bedding, fertilizer, and other useful by-products. Our revolutionary anaerobic digester is the world’s first scalable system to employ a tubular, modular design platform suitable for any size farm, and geared particularly to 100-1,000 cow operations. A typical 300 cow dairy operation would save $130,000 annually for an Avatar digester; after costs this typical dairy would realize an increase in net earnings per cow of 20% putting them on financial parity with their larger competitors.

Later, Avatar’s formal loan applications to the state also promised wondrous results if Nevada would only approve the loans for the company.

An example is the company’s application for money to place an installation at a Fallon dairy:

This project will place an anaerobic digester system designed and installed by Avatar Energy, LLC on a 2,000 cow dry lot dairy farm in Fallon Nevada…

Economically, this project will offset all of the farms utility bills, bedding costs, supplemental heating and improved fertilizer value of their post digester effluent manure, meanwhile improving the overall long term farm sustainability. Environmentally this project will substantially improve water and air quality of the farm and surrounding community.

In actuality, despite its big talk and even four years later, Avatar has never built any of the anaerobic-digester installations called for by the company’s loan contracts with the state. That is even after the state energy office had granted the companies new payment plans in 2012, 2013 and 2014.

Finally, in November 2014, the State of Nevada went to court.

Deputy Attorney General Harry Ward, in the First Judicial District Court, filed for, and received, summary judgments against the Avatar companies and their CEO, managing member and primary owner, Stephen C. Wampler — coincidentally the husband of Avatar Energy LLC CFO Catherine Brennan — for over $10 million. Some $4 million of that sum represents unpaid interest and penalties.

Crowley, appointed to her position by Gov. Brian Sandoval and who took office in 2011 with the governor, resigned her Office of Energy position in 2013 and accepted a job with the California Independent System Operator, the quasi-government agency that manages the flow of electricity across that state’s power grid.

So far, neither the Sandoval administration, its office of energy, nor the members of the legislature’s Interim Finance Committee panel charged with vetting applicants and overseeing the ARRA money, have publicly acknowledged, nor taken responsibility for, the actual record that Nevada’s revolving renewable-energy loan program produced. Nor will Reid’s annual conference be acknowledging the wasteful track record of government attempts to pick, choose and massively subsidize green-energy projects. Even in 2012, Nevada Journal showed that$1.3 billion in clean-energy subsidies in Nevada had produced only 288 jobs.

The silent pretense, however, rolls on.

“Nevada’s business friendly climate, streamlined permitting, and enhanced incentives offered through my Office of Energy have proven to developers around the world that Nevada means business,” said Sandoval last year in a photo-op before the famed “Welcome to Fabulous Las Vegas” sign.

“I’m committed to the development and exportation of renewable energy by removing barriers and developing better business models,” he asserted.

Steven Miller is managing editor of Nevada Journal, a publication of the Nevada Policy Research Institute, a non-profit, non-partisan think tank that produces and shares ideas and information that empowers people. For more information, please visit www.NPRI.orgwww.NPRI.org.

The column was originally published on Nevada Journal.

Facebook

Twitter

Pinterest

RSS