Gov. Brian Sandoval appears to be overly concerned that his signature legislative achievement, the Commerce Tax, might not stand the test of time — at least that’s the impression given by his misleading statements to media outlets on the subject.

Since learning in late 2017 that Nevada’s Attorney General (and 2018 Republican gubernatorial candidate) Adam Laxalt supports the concept of repealing the Commerce Tax, Gov. Sandoval is on-record as having proclaimed the following with regards to the financial impact of repeal:

“[Repealing the Commerce Tax] is going to hurt kids, going to hurt teachers, it’s going to hurt parents. Every single [new] program would be eliminated.”

That’s pretty apocalyptic talk. He continued:

“Anyone supporting a repeal of the Commerce Tax must explain to Nevada’s children, families and businesses which education initiatives will be cut if it is eliminated…Will they cut gifted and talented programs, end all-day kindergarten, eliminate special education resources, decrease literacy programs that help students read by third grade, cut autism funding, stop career and technical education, and get rid of technology in schools grants? Any discussion of eliminating this revenue source must include answers about where in the budget they will cut.”

Sandoval’s attempts to paint repeal as a grave injustice to the state’s ailing education establishment, however, have no basis in fiscal reality.

Contrary to what the outgoing governor suggests, education spending is set to increase every year into the foreseeable future, even before Commerce Tax revenues are taken into account.

What this means, is there will be no need for cuts in education — or anywhere else — in the event that Nevadans choose to repeal the governor’s ill-conceived gross-receipts tax at the ballot box or through their elected representatives.

Indeed, even without the Commerce Tax, politicians will be more than able to do what they normally do when it comes to Nevada education: Continuously throw more and more money against the wall, year after year, hoping for something to stick.

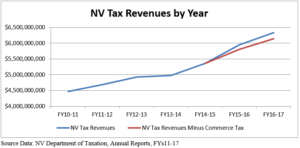

A review of fiscal 2017 data from the Nevada Department of Taxation confirms this.

The data reveal that statewide revenues increased by nearly $400 million last year, producing total revenues of about $6.3 billion. Of that $6.3 billion, less than $200 million was attributable to the Commerce Tax.

In other words, even if the Commerce Tax had failed to collect a single dime, the state would still have seen nearly $200 million in additional revenue from the year prior — an annual increase of about 3.3 percent.

Facebook

Twitter

Pinterest

RSS